5 BENEFITS OF CHOOSING A REGULATED FOREX BROKER

The Forex market is the biggest and most liquid market in the world valued at $2.4 quadrillion with daily trading volumes reaching as high as $6.6 trillion dollars. With a Forex broker regulated by MAS with competitive spreads, you’ll be able to tap into a world of possibilities to capture opportunities and make profits safely.To get more news about cffex regulated forex brokers, you can visit wikifx.com official website.

While Forex is indeed exciting and unique, choosing the right broker can be confusing with all the options available in the market.

However, when choosing your broker, you shouldn’t just pay attention to only the spreads or commissions you are paying, but also if the Forex broker is properly regulated.

Choosing the right broker can mean the difference between if your trading funds are safe or are at risk. A regulated broker is one whose activities are monitored and controlled by a local regulatory authority to prevent any fraudulent activities or excessive risk-taking by the broker.

In this article, we will go through the advantages of choosing a regulated Forex broker to trade the world of currencies.

5 Key Benefits A Regulated Forex Broker Delivers

1. Regulation By The Monetary Authority of Singapore (MAS)

MAS is a top-tier financial authority whose primary goal when it comes to regulating Forex brokers is to keep traders safe and give them a peace of mind.

Brokers regulated by MAS are required to ensure that the money of retail clients are kept safe in the event of a broker collapse or liquidation.

Measures have been taken to ensure the financial stability and health of the broker as well as making sure that no client money is used for the firm’s own business activities.

When choosing a Forex broker in Singapore, ensuring they hold a Capital Market Services (CMS) license issued by MAS is key.

It ensures that the broker follows a set of strict regulations from MAS that helps to protect traders and investors.

2. Your Trading Funds Are Safe, Secure Segregated

As a client, the last thing you’d want is your trading and investment funds to be at risk.

As a regulated and licensed Forex broker, one of the requirements is to have segregated financial accounts that separate the clients’ funds from your own business funds.

This helps to ensure that in the event a broker faces difficulties, investors will be able to withdraw their money and not lose their funds in that event.

Investors will be able to withdraw their funds without any risk, whenever they want.

Regulated brokers will have to hold separate bookkeeping for the segregated funds as well as part of the regulatory requirements. This helps to better keep track of where the funds are, allowing for the prompt return of clients’ money should a liquidation event happen.

3. High Credibility Adherence To Guidelines

For MAS regulated Forex brokers, it is required that employees in the firm are qualified in the money markets and it is a requirement for brokers to provide a list of their employees and qualifications prior to opening their business in Singapore.

Additionally, brokers will also be required to provide information on their range of trading instruments on offer to clients such as Forex, futures, stocks or options.

Because of the strict guidelines, regulated brokers are also required to adhere to proper bookkeeping and accounting practices to ensure that their business transactions do not overlap with any movement of their clients’ money.

This means that not only are clients’ money safe and segregated, the company is also operationally stable and effective. This lends more trust to customers who deserve effective execution of their orders as well as a continuity of their trading experience without facing any disruption.

4. Transparent Honest Trading Operations

Transparency of your broker is essential. This extends to making transparent trades as well as offering a comprehensive listing of their commissions and trading spreads.

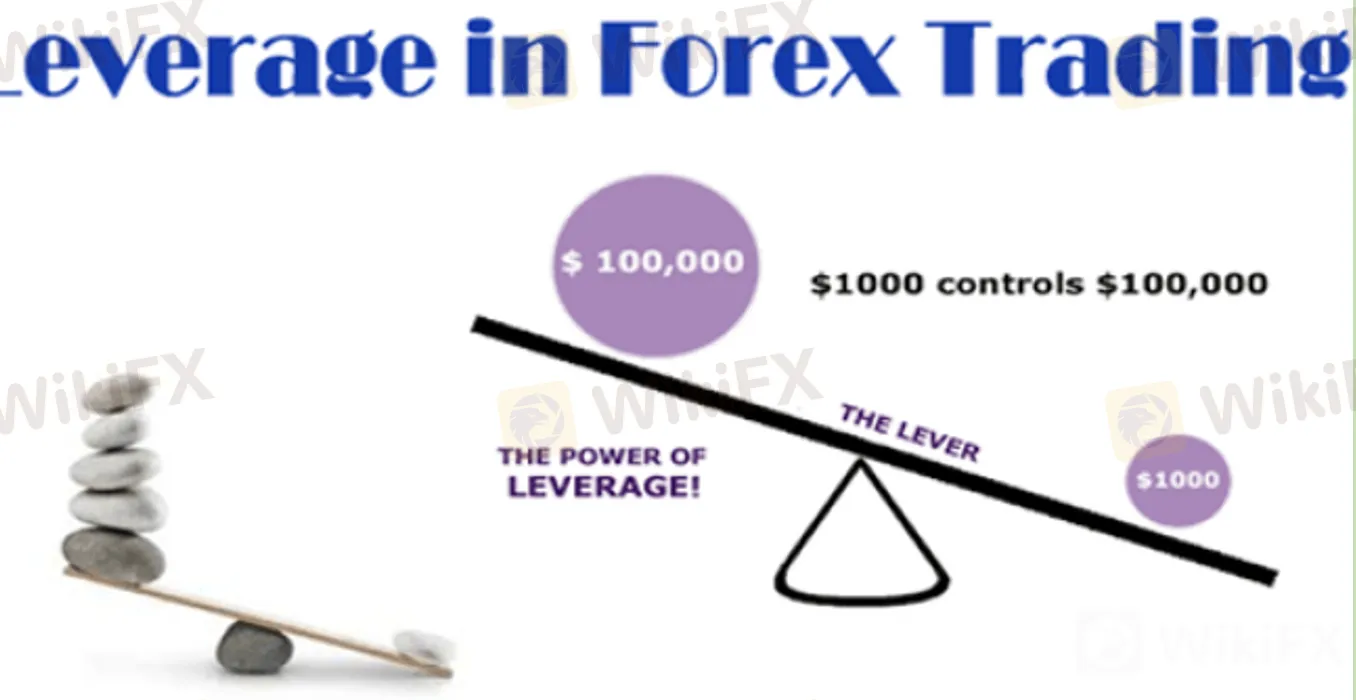

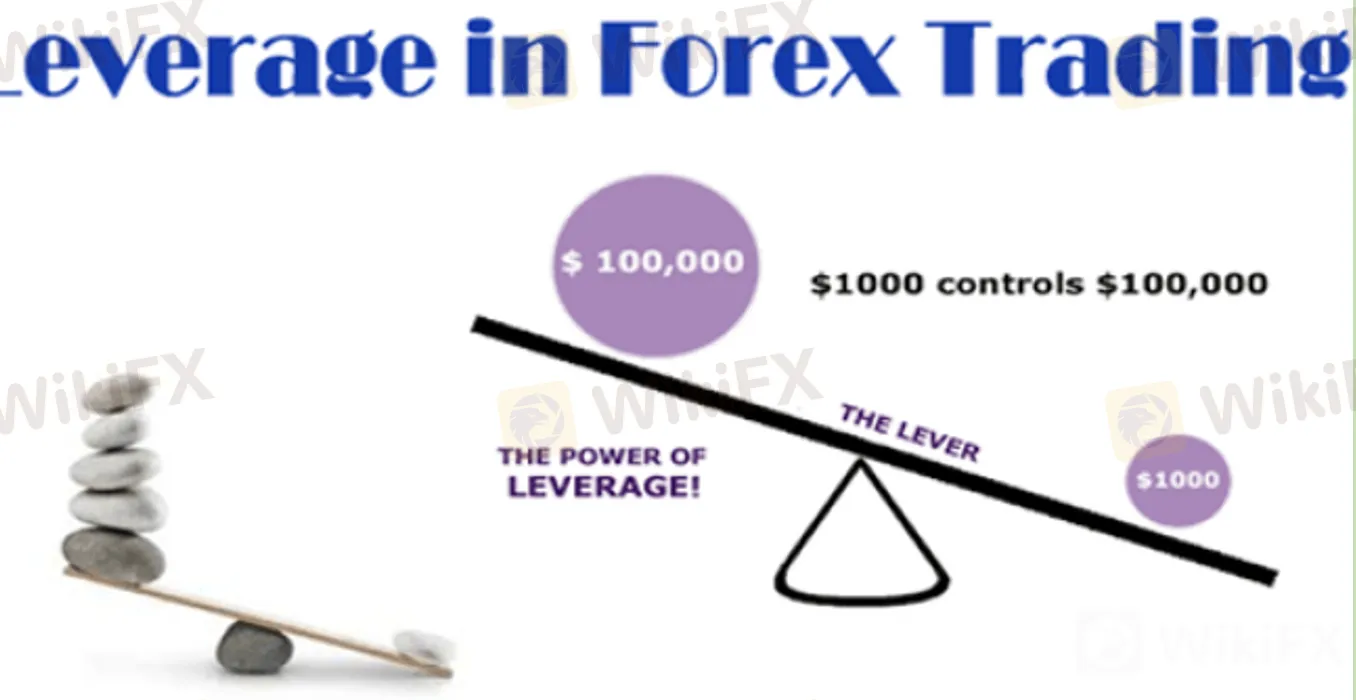

This also means being transparent to the regulatory body, MAS, in their trading activities such as the margins and leverage being made available to clients.

Transparent operations also extend to the business practices of the broker. One that is regulated will ensure that their claims and offers are above board as most importantly not misleading to prospective clients and traders.

5. Superior Customer Support

While all brokers should aspire to provide the best possible customer service and support, regulated brokers are more motivated to ensure clients stay happy and satisfied with the service being provided.