One of the top cryptocurrency exchanges, OKX (formerly known as OKX), serves as a facilitator for users to trade hundreds of crypto tokens and futures trading pairs. The exchange, which was established in 2017 and has its headquarters in the Republic of Seychelles, has a sizable trader base and competes with other important exchanges like Binance.

Before entering the cryptocurrency sector, OKX CEO JayHao worked in the semiconductor and game development industries. The exchange expanded its reach in 2018 to Malta, a country that embraced cryptocurrencies.

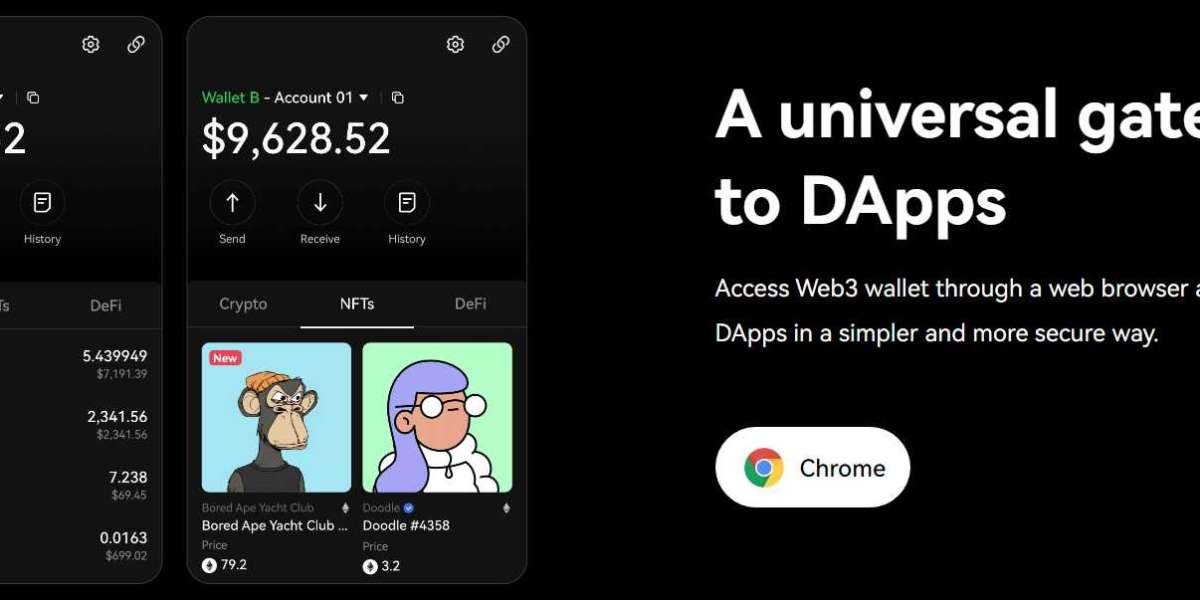

A wide variety of tradeable assets are available through OKX, which also makes it feasible to gain exposure to both spot and futures trading. There are more than 350 digital tokens available on the platform, along with an astounding 500+ BTC and USDT trading pairs. This includes the Blockchain Foundation-issued native utility token OKB for the platform, which is utilized for various trade bonuses and benefits.

Trading fees of OKEX Exchange

The OKX exchange fee structure on the platform is dependent, like with other exchanges, on whether the investor is a market maker or a market taker. The majority of traders are market takers since capital size matters, and as a result, they have a certain charge structure comparable to OKX competitors.

Market takers pay different trading commissions based on a "tier" structure, which works out to 0.10% for spot trading. This is under the sector average of 0.25 percent. The tier system is determined by a trader's amount of spot trading.

For instance, the market taker costs drop to 0.095% if a bitcoin trader reaches a spot trading volume of more than 500 BTC. VIP members can benefit from trading fees that are 0.020%–0.080% more affordable.

The taker fees for futures contracts follow the same tier scheme and vary from 0.03% to 0.05%. At the same time, there are no deposit fees on the OKX platform, withdrawal fees of 0.0004 BTC for bitcoin, 0.003 ETH for Ethereum, and 0.1 XRP for Ripple must be paid. The withdrawal charge at OKX is generally a little less than at other exchanges. The OKX withdrawal costs may change during the time of trading as they are updated often.

The Bottom Line

OKX is a one-stop shop for trading and investing in cryptocurrencies. The exchange says that it has never been hacked and that its costs are in line with industry norms, despite persistent rumors to the contrary. OKX is owned by The OK Group, which also operates the cryptocurrency exchange of OKCoin. Investors based in the US are not yet allowed to access it.

At the end of the day, OKX is one of the top 30 exchanges with plenty of liquidity; without doing anything well, it would not be there.

We hope that our blog provides you with all the necessary information about OKEX Exchange and its trading fees. But if you still have doubts regarding the OKEX Exchange, you can call its Customer care number and ask your query.