Veterinary API Market in terms of revenue was estimated to be worth $5.2 billion in 2023 and is poised to reach $7.1 billion by 2028, growing at a CAGR of 6.5% from 2023 to 2028 according to a new report by MarketsandMarkets™.

Veterinary API Market by API Type (Antimicrobials (Fluoroquinolones, Tetracyclines), Vaccines, Hormones, Antimicrobials, Anti-inflammatory, Hormones), Synthesis Type, Route of Administration, and Animal Type - Global Forecast to 2028

The market for veterinary API is expanding because of factors like rising incidence of transboundary & zoonotic diseases, increasing animal population and pet ownership, and increasing disease control & disease prevention measures. The veterinary API industry is anticipated to develop because of the rising demand for veterinary medicines and other animal health products. This is also going to attract international investors to that region.

Download an Illustrative overview: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=91801752

In this report, the Veterinary API Market is segmented based on API Type, Synthesis Type, Route of Administration, Animal Type, and region.

“Oral segment in Route of administration was dominated by the highest share in Veterinary API Market”

The Veterinary API Market is divided into four types based on Route of administration such as Oral, Injectable, Topical, and Others. The Oral segment accounted for the highest share of the global Veterinary API Market in 2022. Oral administration of veterinary drugs is relatively easy and can be performed by the pet owner or veterinary professional. It typically involves the use of tablets, capsules, liquids, or treats that can be readily consumed by animals. The oral route is suitable for a wide range of veterinary drugs, including antibiotics, antiparasitic, analgesics, and medications for chronic conditions.

“Companion animal segment was dominated by the highest share in Veterinary API Market”

The Veterinary API Market is segmented based on animal type into two categories: companion animals and livestock animals. In 2022, companion animals dominated the Veterinary API Market, holding the largest market share. This can be attributed to the increasing focus on preventive healthcare for companion animals and the rise in pet ownership, among other factors. These factors have contributed significantly to the significant proportion of the market occupied by companion animals.

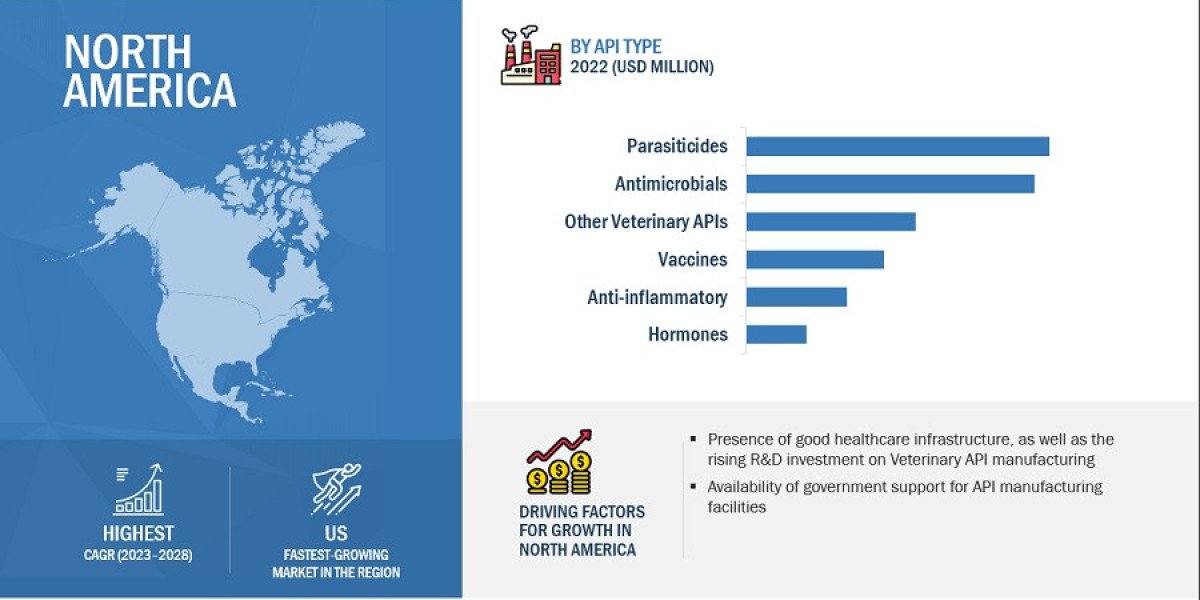

"North America accounted for the largest share of the Veterinary API Market in 2022"

The Veterinary API Market is categorized into five geographical regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2022, North America emerged as the dominant region, capturing the largest market share for Veterinary APIs globally. The growth of the North America market is expected to be driven by factors such as increased investments in research and development for veterinary API manufacturing and government backing for the establishment of API manufacturing facilities.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=91801752

Veterinary API Market Dynamics:

Drivers:

- Rising incidence of transboundary & zoonotic diseases

- Increasing animal population and pet ownership

- Increasing disease control & disease prevention measures

- Growing demand for animal protein

Restraints:

- High costs of veterinary diagnostic and treatment

- Growing concerns about antibiotic resistance

Opportunities:

- Rising awareness about animal health and welfare

- Untapped emerging economies

Challenges:

- Growing concerns about antibiotic resistance

- Challenges In Large Molecule Api Synthesis

Key Market Players:

The prominent players in the global Veterinary API Market are

- Phibro Animal Health Corporation (US)

- Fabbrica Italiana Sintetici S.p.A. (Italy)

- Sequent Scientific Ltd. (India)

- Excel Industries Ltd. (India)

- NGL Fine-Chem Ltd. (India)

- Insulnsud Pharma (Spain)

- Menadiona Sl (Spain)

- Rochem International Inc. (US)

- and Shaanxi Hanjiang Pharmaceutical Group Co. Ltd. (China)

Get 10% Free Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=91801752

Recent Developments:

- In 2021, Sequent Scientific Ltd. (India) received WHO–GENEVA approval for API Praziquantel (Anthelmintic) under the prequalification program.

- In 2020, Sequent Scientific Ltd. Opened a state-of-the-art animal health R&D center in Mumbai, India.

Research Insight: https://www.marketsandmarkets.com/ResearchInsight/veterinary-api-market.asp

Content Source: https://www.marketsandmarkets.com/PressReleases/veterinary-api.asp